Need help getting on the property ladder? Our Head Start Mortgage provides a way for family members to help the younger generation buy a property.

Alternatively, suppose your circumstances change and you face the prospect of not being able to afford your family home. In that case, our Head Start Mortgage allows family members to help make staying a reality.

These types of mortgages are known by a few different terms like ‘family assisted mortgages’ or ‘family offset mortgages’ and aim to allow families to help each other buy a property.

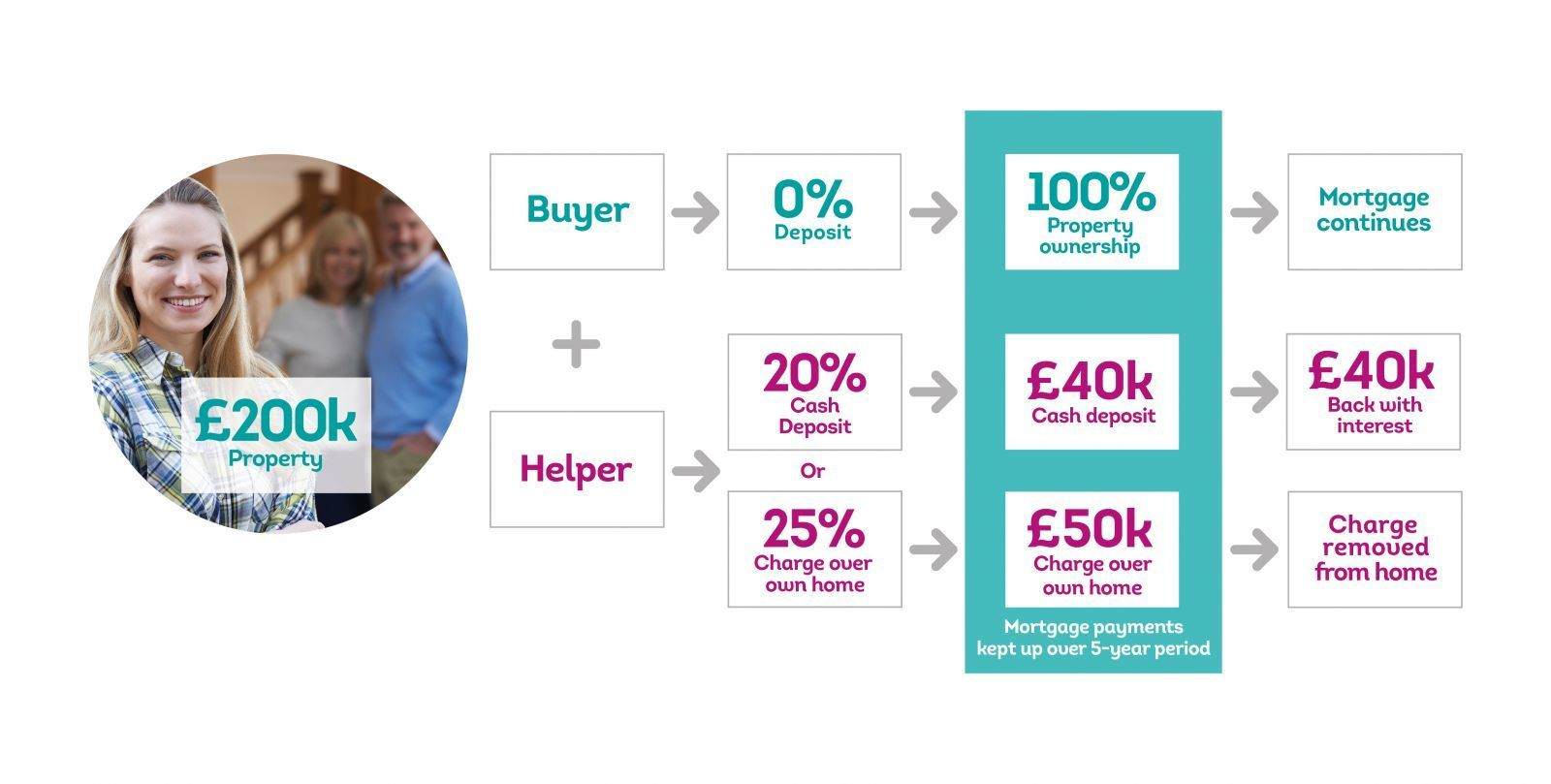

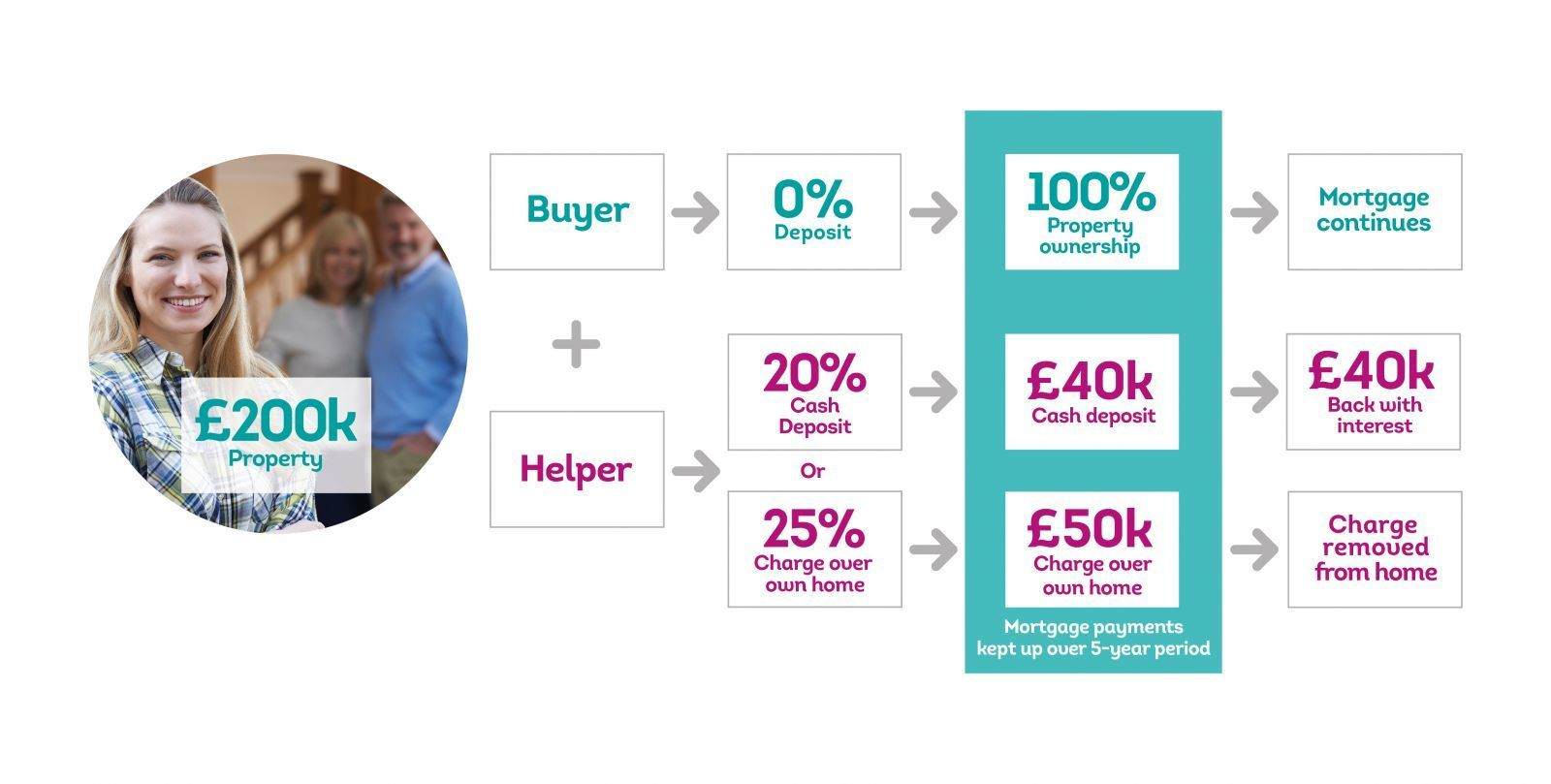

A Family Assisted Mortgage allows the Buyer to purchase a property in their own name with a mortgage of up to 100% of the property’s value. This is done with the support of one or more family Helpers who will be joint borrowers on the mortgage. The Helper(s) will also provide additional security in the form of a cash deposit or a charge over their own home.

Get help purchasing the property and still have full ownership.

You can borrow up to 100% of the purchase price.

With support from a Helper, you may be able to borrow more.

Take out over a term of up to 35 years to bring down monthly costs.

Your contribution earns interest in a Vernon savings account during the security period.

So long as the mortgage terms are met, you'll get your contribution back with interest after 5 years.

Feel good knowing a family member is getting a head start with their home purchase.

As long as it's affordable, you can support multiple Buyers purchase their home.

Complete our quick online enquiry form and we'll get back to you within one working day.

ENQUIRE ONLINEArrange to meet an expert Mortgage Adviser in one of our six branches.

BRANCH FINDERThese FAQs are designed to provide an overview of important information about our Head Start Mortgage. Your Mortgage Adviser will explain how the product works in detail. If you are unclear about any aspect of this product, make sure that you get clarity from them.

How does Head Start work?

How much can I borrow?

What is the repayment basis for a Head Start mortgage?

What is the maximum/minimum mortgage term?

How do you assess affordability?

How does the Helper support the Buyer?

What security is required?

What happens if the mortgage account goes into arrears?

What happens if the property is repossessed?

Will all borrowers get regular statements?

Who is eligible to apply?

Who owns the property?

Are there restrictions on the property?

Do I have to be a first-time buyer to apply for a family assisted mortgage?

What is a Helper?

Who can be a Helper?

Can more than one Helper provide support?

Can a Helper help more than one member of their family at the same time?

What legal charge is taken over a Helper’s property?

Are there restrictions on the property to be used as supporting security?

What is a cash security?

Do you pay interest on the cash security?

Is a cash security covered by the Financial Services Compensation Scheme?

Can additions or withdrawals be made to the cash deposit?

Can a combination of cash security and charge over property be used?

When does a Helper need to get independent legal advice?

What is the extent of the Helper’s liability?

How is a Helper released from their commitment?

What happens if a Helper dies?