Need help getting on the property ladder? Our Head Start Mortgage provides a way for family members to help the younger generation buy a property.

Alternatively, suppose your circumstances change and you face the prospect of not being able to afford your family home. In that case, our Head Start Mortgage allows family members to help make staying a reality.

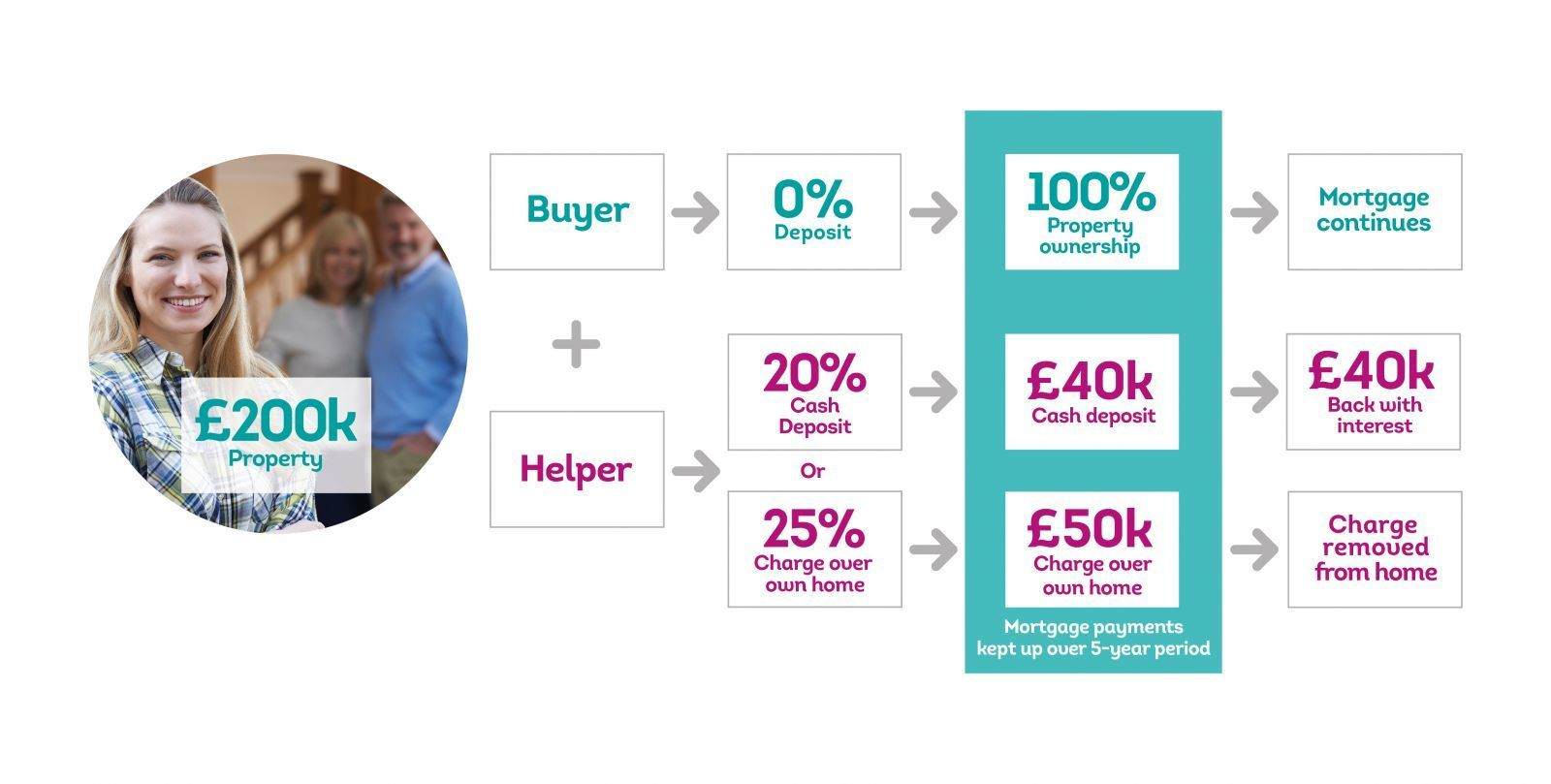

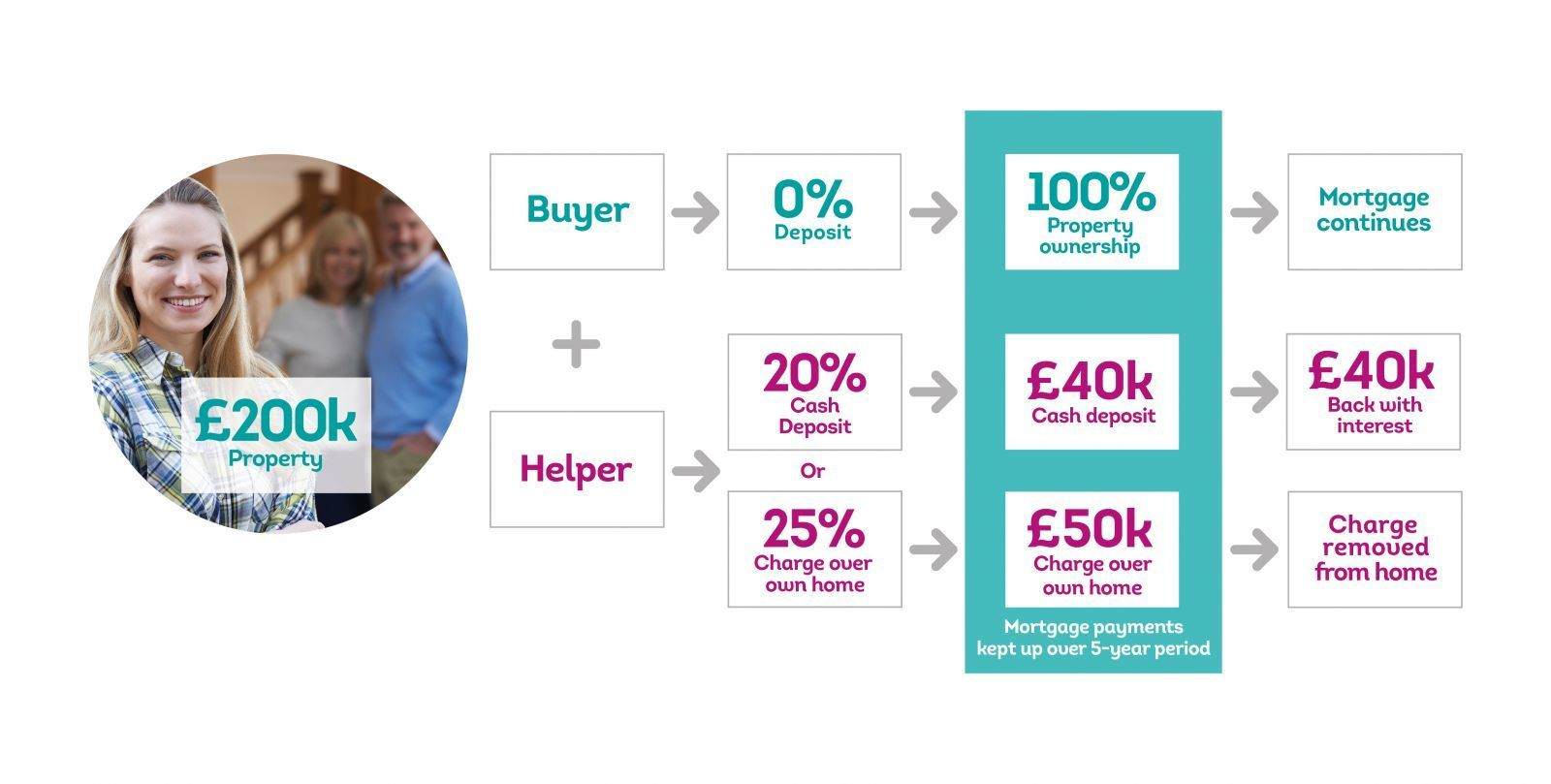

With a Head Start Mortgage, the Buyer purchases a property in their own name with mortgage of up to 100% of the property’s value. This is done with the support of one or more family Helpers who will be joint borrowers on the mortgage. The Helper(s) will also provide additional security in the form of a cash deposit or a charge over their own home.

Get help purchasing the property and still have full ownership.

You can borrow up to 100% of the purchase price.

With support from a Helper, you may be able to borrow more.

Take out over a term of up to 35 years to bring down monthly costs.

Your contribution earns interest in a Vernon savings account during the security period.

So long as the mortgage terms are met, you'll get your contribution back with interest after 5 years.

Feel good knowing a family member is getting a head start with their home purchase.

As long as it's affordable, you can support multiple Buyers purchase their home.

Complete our quick online enquiry form and we'll get back to you within one working day.

ENQUIRE ONLINEArrange to meet an expert Mortgage Adviser in one of our six branches.

BRANCH FINDERThese FAQs are designed to provide an overview of important information about our Head Start Mortgage. Your Mortgage Adviser will explain how the product works in detail. If you are unclear about any aspect of this product, make sure that you get clarity from them.

How does Head Start work?

With a Head Start Mortgage, the Buyer purchases a property in their own name with a mortgage of up to 100% of the property’s value.

The mortgage is supported by a Helper(s) who will be a joint borrower(s) on the mortgage. The Helper(s) will also provide additional security in the form of cash or a charge on their property.

How much can I borrow?

The maximum loan amount is £500,000 and the minimum loan is £125,000.

What is the repayment basis for this mortgage?

The Head Start Mortgage is available on a capital and interest repayment basis only.

What is the maximum/minimum mortgage term?

The maximum mortgage term is up to 35 years, the minimum mortgage term is 5 years.

How do you assess affordability?

A standard full affordability assessment is conducted for all borrowers. If the proposed mortgage is not affordable based on the buyer’s sole income, we can take the Helper’s income into account, we would however require the Buyer to be able to meet at least 75% of the monthly mortgage payment.

How does the Helper support the Buyer?

If the Buyer has less than 20% or no deposit available, then the mortgage can be supported by a Helper either depositing cash into a Vernon savings account or allowing a charge over their own home. This is referred to as ‘security’.

What security is required?

The Head Start Mortgage is a minimum 80% LTV product; therefore, a Helper depositing cash in a Vernon savings account as security will need to provide or (if the Buyer also puts down a deposit) top up to 20% of the purchase price/valuation whichever is the lower. Please note, if the Buyer puts down a portion of the deposit, this is taken as a normal deposit and would not be deposited into a Vernon savings account.

or

Rather than cash, a Helper can take a charge over their own home for the equivalent amount that makes up the 25% of the Buyer’s purchase price/valuation whichever is the lower. There are terms and conditions associated with this route, speak to your Mortgage Adviser for more information.

What happens if the mortgage account goes into arrears?

If mortgage payments are not made, we will contact all borrowers to request that the shortfall is paid.

Should you experience any financial difficulty, it is important that you get in touch with us as soon as possible so that we can give you support and guidance. Any supporting cash security cannot be used to make up missed mortgage payments – this would only be called upon if losses were made on repossession.

What happens if the property is repossessed?

In this unlikely event, the property would be sold and the proceeds would be used to repay the outstanding loan, plus any interest and charges. If the sale proceeds are insufficient, then we would rely on the security provided by the Helper to make up any shortfall.

Will all borrowers get regular statements?

Yes, statements will be issued annually to all borrowers.

Who is eligible to apply?

Buyers who are aged between 18 and under 50 at the date of application.

Who owns the property?

The property is solely owned by the Buyer.

Are there restrictions on the property?

Do I have to be a first-time buyer?

No.

What is a Helper?

A Helper supports the Buyer to purchase a property and jointly borrows the money, jointly agrees to meet the monthly payment and provides security.

Who can be a Helper?

A Helper can be a parent(s), step-parent(s) or an aunt/uncle. In some circumstances, we can consider other close family members instead.

Can more than one Helper provide support?

Yes. You should note that all Helpers would be named as joint borrowers on the mortgage.

Can a Helper help more than one member of their family at the same time?

Yes, this is certainly possible for the cash deposit route. Multiple charges over the Helper’s home as security would depend on several factors. Speak to us for more information on terms and conditions associated with this route.

What legal charge is taken over a Helper’s property?

If there is no mortgage on the property, then we take a first legal charge. Where there is an existing mortgage, we take a second legal charge.

Are there restrictions on the property to be used as supporting security?

The property must be in England or Wales. If it is in joint names, then it must be as Joint Tenants and not Tenants in Common. If there is a mortgage already on it, then the value of the house must be more than £250,000 and the combined mortgage and second charge must not exceed 70% of its value.

What is a cash security?

Cash security is a deposit placed in a savings account with the Society and a legal charge is taken over it. This means that the cash can be used to repay any losses that the Society may incur in the event of repossession and sale of the property.

The cash will be deposited into a 35-Day Notice Account and interest will be paid throughout the period of security. The Vernon may change the interest rate on this account at any time.

Do you pay interest on the cash security?

The cash security will be deposited into the Vernon’s 35-Day Notice Account and will receive the interest payable on this account type. More information, including the interest rate payable, can be found on our website. Full details will be provided to you during the application process.

Is a cash security covered by the Financial Services Compensation Scheme?

Yes, full details of FSCS cover will be provided when a 35-Day Notice Savings Account is opened.

Can additions or withdrawals be made to the cash deposit?

As the funds are being used as security for a loan, no withdrawals or further deposits can be made to the account until the minimum 5-year term has passed. Therefore, we will not issue a passbook for the account.

Can a combination of cash security and charge over property be used?

No, we would require one or the other, not a combination of both.

When does a Helper need to get independent legal advice?

As a Helper(s) is a joint borrower on the mortgage loan, they will receive legal advice from the solicitor for the purchase (purely regarding the purchase). However, where additional security is being provided, the Helper(s) is required to obtain legal advice from a solicitor that is independent to the house buying process to avoid any conflicts of interest. Any cost for this advice will be met by the Helper(s).

What is the extent of the Helper’s liability?

The Helper(s) is jointly and severally liable for the full mortgage amount and all repayments while they’re on the mortgage. If repayments are not met and this ultimately leads to us taking possession of the property, then all borrowers are liable for any shortfall that may occur after the sale of the property. Where additional security has been given, in the form of cash or property, then this may be used to make up this shortfall. This will be explained by your legal representative during the house purchase process.

How is a Helper released from their commitment?

So long as the Buyer and Helper(s) have met all the contractual terms of their mortgage, the Helper will receive their security back after five years.

After these five years, to be fully released from their commitment and responsibility for the mortgage, an affordability assessment will be conducted to prove that the Buyer can afford to take on the mortgage by themselves.

What happens if a Helper dies?

The deceased’s liability would remain, as would any charge over cash or property. Should this occur, we would discuss the options with the representatives of the deceased’s estate.